|

|

| Home › Articles › Here |

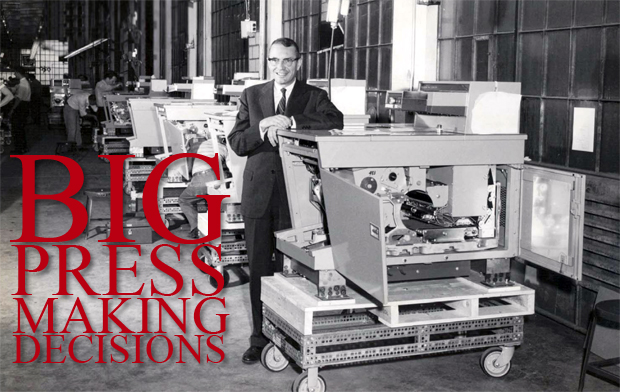

Joseph Wilson, Xerox CEO from 1946 to 1966, with the company’s first automated copier, Xerox 914, a key piece of printing machinery evolution. |

|

||||||||||||||

| By: Nick Howard | Date: June 2010 | Contact the Author |

|||||||||||||||

Cont'd from Part 1 |

|||||||||||||||

| As we now read Heidelberg’s quarterly

financial statements, the company, along

with all of the other major press makers,

are publicly stating that they cannot expect

to build and sell nearly as many machines

as in the past. Much of the

attention around the decline in offset

press manufacturing is certainly placed

on Heidelberg, because of its long history

as being the largest press maker and its

sudden financial challenges, but make no

mistake, all of these giant manufacturers

are facing similar challenges. The press makers have in fact been trying to adjust their manufacturing focus for a couple of years now. Gone, or nearly gone, from all of the major press builders are the 4-colour, 5-colour and 6-colour machines with, for example, 2/4 perfecting capabilities. These presses are now replaced with coaters as the essential feature. As of late, various builders have also thrown in the towel on what might be referred to as basic machines. These presses were essentially stripped of certain automation and delivered to priceconscious printers. Such machines, in reality, carried the same press architecture but were targeted at particular rogue players ready to undercut everyone in the market. But inevitably, this environment was going to hit a dead end, which I believe is where we are now all standing, and it is becoming very difficult to breakthrough or to find a new direction. Market-defining moments How does any company of huge manufacturing proportions deal with an evershrinking market base? This is a question that all the big-iron players are now dealing with. Some have decided to focus their growth on building larger XXL format machines, but even they would be quick to point out that this is a relatively small market already with a stable install base. While many market surveys have been published indicating that this extralarge offset format is growing in popularity, the reality is that advancing such press technology is very expensive in terms of R&D spend. We also hear a lot about the benefits of lean manufacturing, which is certainly a viable strategy but one that is really a formula of dollars-and-cents for large-size printers and a formula of common sense for most small- to -medium-sized printers. In other words, in pressrooms where large print runs still take place lean manufacturing takes hold because every cent saved multiplies, every hour shaved means margins. Meanwhile, most traditional commercial printers deal with a different manufacturing axiom: Run lengths shorten, pricing pressures remain constant and manufacturing costs continue to escalate. Both the builder of equipment and the user are dealing with exactly the same issues. Heidelberg could not afford to delay the launch of the long perfector just as Toyota could not delay the hybrid car. If they didn’t someone else would. Now with stability returning to the printing industry, will there ever be as many machines sold as before? That is a question of which the answer may very well be no. One 8-colour perfector can out work two or three straight 4- and 5- colour presses if the work is all colour which most of it is. That alone should indicate the units sold per year will be less. The other important ingredient is speed and make-ready. These presses all outperform technologically deficient equipment made even five years ago. The press boardrooms in Augsburg, Heidelberg, Offenbach and Tokyo are busy determining the next steps in how to bring offset equipment to market. Make no mistake, these are major decisions being made today about the true future of printing, whether focused on various factory reductions, changes in R&D spend, or ultimately determining how to key facilities to build certain machines. Most of the press makers are looking very hard at alternate forms of imaging, which can be integrated into 29- and 40-inch format presses, run at high speeds and produce virtually zero waste. For example, based on Heidelberg’s relationship with Gallus, or Komori’s Chambon subsidiary, packaging printers may one day soon see press technologies that feed from a roll and completely finish a box. With all of these press makers so intently focused on upgrading performance, their recent innovations have a significant impact on the pricing of used machinery. The general malaise in the Canadian and U.S. markets seems to have created an environment in which only printers in developing countries are searching for used equipment. This situation, along with higher technology demands here in North America, have led to a free fall in values as only those foreign customers with smaller budgets are bidding. This is a major reason why prices are so low. Price-adjusting moments Further pressure is placed on the price of used press, because of the fact that new equipment has never sold for less in this country. Today, meanwhile, printers cannot afford to invest in old technology, if they hope to remain competitive not just with fellow printers but also with the immediacy and relatively cheap cost of producing on-screen communications. The cost of printing has dropped so much that older presses are not capable of producing a profit. The way forward is pretty clear: If our industry does not search out for the most-advanced equipment, we can never maintain our place in the communications mix. Of course, this introduces another major hurdle in that the availability of financing has become a major roadblock for most printers hoping to make new capital investments. Several key lenders have either retrenched or are exiting the printing industry. However, there is enough stability back in the economy so that credit is loosening up and, at the end of the day, this general lack of access to financing does have a silver lining for printers who have been running a fiscally responsible business for years. I seriously doubt we will ever again see the day when the generosity of press manufacturers puts a start-up printer in business for the sake of market share. I worry, however, that even with more positive signs starting to emerge for the industry, some printing companies may still not accept the need for modernization in the pressroom. |

|||||||||||||||

| Contact the Author | |||||||||||||||

|

|||||||||||||||